Covid-19 Pandemic Period, This is the Role of OJK Against Government and Bank Indonesia Policies in the Financial Services Industry

5 min read

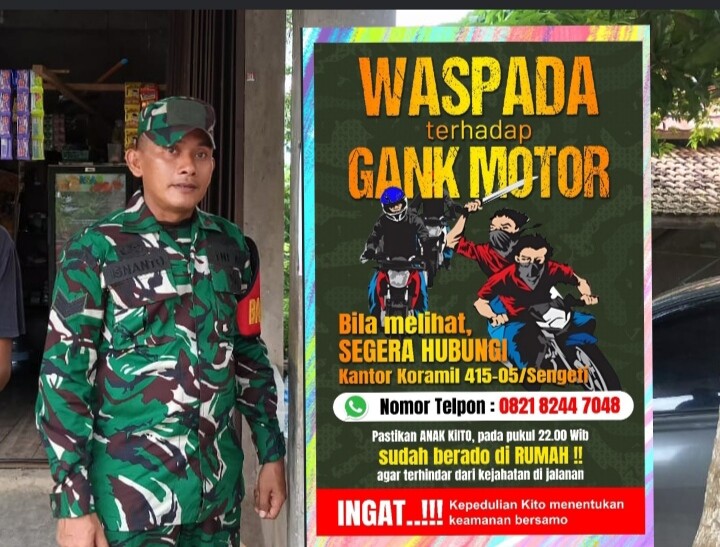

Press Conference at the Jambi Province OJK Office, the Sipin area of Jambi city/Foto: Hendry Noesae

JAMBIDAILY ECONOMI – Considering the impact of the co-19 pandemic on the economy was so great, the Financial Services Authority (OJK) continued to provide support for various policies in the Financial Services Industry during the co-19 pandemic

The impact was seen in the global economic realization of Q1 2020 experiencing a contraction below market expectations, the economic slowdown has been reflected in Q1 2020 GDP growth and April Manufacturing PMI data in the contraction zone and below market expectations. This has an impact on domestic economic growth. Indonesia’s GDP growth is currently lower than GFC 2008/09 but the future trajectory is still unpredictable and is very dependent on the recovery of Covid-19 itself.

Also for the real sector, such as the Indonesian Manufacturing PMI fell from 45.3 in March to 27.5 in April which is the lowest position for the past 9 years, Tourist arrival in Indonesia in April 2020 is expected to contract again by 69% yoy so will greatly affect Indonesia’s service balance (Source: IHS Markit, BPS, BI, CEIC).

The Government and BI make fiscal and monetary policies to mitigate the impact of Covid-19

1. Maintain consumption

- Subsidies and Social Aid for poor and vulnerable people Additional food, pre-work cards, electricity tariff exemptions, PKH distribution, social assistance

- Additional consumption stimulus for tourism, restaurants and transportation

2. Supporting UMKM and Maintaining Investment

- Interest subsidies for UMKM and ultra-micro businesses for 6 months.

- Placement of funds for financial service institutions that carry out credit / financing restructuring and additional credit / working capital financing.

- Guarantee scheme to support UMKM working capital loans.

3. Supports Export Import Activities

- Provide tax incentives, customs and excise, compensation funds and Participation of State Capital to SOEs.

- Accelerating the process of import and export

Policy mix to stabilize the exchange rate and control inflation and encourage quantitative easing (QE) policies

- Lower the BI 7-Day (Reverse) Repo Rate

- Increase the intensity of triple intervention in the spot market, DNDF, and purchase of SBN in the secondary market

- Extend the SBN repo tenor and daily auction to strengthen rupiah liquidity easing and increase the frequency of FX Swap auctions to every day to ensure adequate liquidity

- Buy SBN and SBSN on the primary market to help the Government finance the handling of the Covid-19 impact

Liquidity injection policy:

- Buy Government bonds in the secondary market

- Banking term repo

- Reducing the Statutory Reserves (GWM)

- Adjustment of macroprudential intermediation ratio (RIM)

Then Transmission to the Financial Services Industry that has an effect on the financial market began to strengthen moderately, credit growth and bank deposits, bank credit growth, non-bank financial industry growth, credit risk has increased, LJK solvency ratio is still quite solid, the development of weekly banking liquidity, indicators interbank financial markets, financial system stability is maintained.

OJK Stimulus Policy to support business actors in the real sector and maintain financial system stability, Economic Recovery Program: Buffering Liquidity, Interest Subsidies, Working Capital Loans. And others.

The government disbursed a national recovery program worth Rp 642.17 Trillion, meanwhile Quantitative Easing by Bank Indonesia Worth Rp 503.8 Trillion

Endang Nuryadin, Head of Jambi Province OJK (Friday, 05/07/2020) in his press statement explained that OJK’s role in the National Economic recovery program, such as giving breath to the real and informal sectors to be able to survive in the co-19 pandemic through relaxation credit/financing restructuring, Providing relaxation for the financial services industry through the imposition of additional reserves for non-performing loans with: relaxation of determining the quality of credit/financing affected by Covid-19 based only on the accuracy of pay factors; relaxation of the determination of the quality of direct credit / financing smoothly for debtors restructured due to Covid-19.

“Also Supporting the program of providing adequate liquidity space to support liquidity needs in carrying out the policy of providing stimulus to the real sector together with the Government and Bank Indonesia and Supporting the program of providing subsidized interest for UMKM and the Informal Sector. Then the national economic recovery, such as the Buffer Liquidity policy for LJK relaxation and the interest subsidy / margin subsidy policy for relaxation of debtors,” Clearly Endang Nuryadin, told media crews at the OJK Office in Jambi Province, the Sipin area of Jambi city.

Liquidity and interest subsidies in principle Regulate the placement of government funds to provide liquidity support / support to banks conducting credit / financing restructuring and / or providing additional credit / working capital financing. In this case, the Government through the Ministry of Finance places funding to Participating Banks, then distributed to Implementing Banks including BPR / Financing Companies (through Executing Banks), in addition the Government provides interest subsidies / margin subsidies to debtors as a further restructuring effort for UMKM / informal to give a longer breath in order to survive in the Covid period.

Then further rules are needed, namely:

- SKB is needed regarding the Procedure for Providing Information in the context of Fund Placement and Interest Subsidies (SKB has been signed)

- NK OJK LPS adjustments related to information exchange and joint inspection (in process)

“Liquidity policy, It needs PMK regarding Fund Placement, NK OJK BI needs adjustments related to Short-Term Liquidity Loans (PLJP) and Special Liquidity Loans (PLK). While the interest subsidy policy, it needs PMK on the Procedure for Giving Interest Subsidies / Margin Subsidies for UMKM Credit / Financing d / r Supports the Implementation of the PEN Program. Everything is still in the process,” Endang Nuryadin said.

Some OJK Roles in the Framework of Fund Placement and Interest Subsidies

- OJK provides information as a basis for approval regarding Banks that meet the criteria for Participating Banks in the Fund Placement Program

- OJK provides the information needed for Fund Placement proposals from Participating Banks

- OJK provides information on proposals for extension of Fund Placement from Participating Banks

- OJK conveys information about UMKM debtors in banks and Financing Companies as well as PT PNM (Persero) & PT Pegadaian (Persero) that meet the requirements for interest subsidies.

- Develop policies and Standard Operating Procedures (SOP) so that all programs can be carried out transparently, accountably, and in accordance with the principles of Good Corporate Governance

(Hendry Noesae)

Powered by: google translate